Remortgages (Freehold and Leasehold)

Our fees cover all of the work* required to complete the remortgage of your existing home, including dealing with registration at the Land Registry

Our fees and disbursements

We charge legal fees on a fixed fee basis which depends on the amount of the remortgage that you are obtaining and ranges from £650.00 to £950.00. On average, our legal fees are £725.00 for a property that is being remortgaged for an average remortgage of £200,000.00

Our additional mandatory charges are:

- Electronic Transfer charge - to provide an efficient service to our clients we send large sums of money by bank transfer for which we charge a fee of £42.00 (including VAT of £7.00) per electronic transfer. So, if you have to pay off 2 mortgages as part of the remortgage process, you will be charged £84.00 (including VAT of £14.00)

- Electronic ID Charge - in order to comply with our obligations under money laundering law, we may need to carry out Electronic Identity checks to verify your identity for which we make a charge of £7.00 (including VAT of £1.17) per client

Estimated additional legal fees: £91.00 (including VAT)

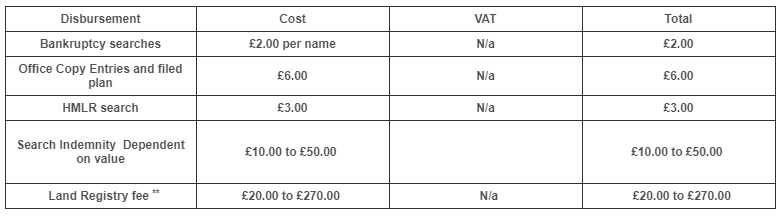

In addition to our charges, you will also have to pay for disbursements, which are costs related to your matter that are payable to third parties, such as land registry fees. We handle the payment of disbursements on your behalf to ensure a smoother process.

Stamp Duty or Land Tax: there is no stamp duty payable for remortgage transactions.

Anticipated Disbursements (Leasehold Properties)

If your property is leasehold, we anticipate the following additional disbursements may be payable.

- Notice of Charge fee (if the property is to be mortgaged) – This fee is set out in the lease. Often the fee is between £100.00 and £500.00.

- Deed of Covenant fee – This fee is provided by the management company for the property and can be difficult to estimate.

These fees vary from property to property and can on occasion be significantly more than the ranges given above. We can give you an accurate figure once we have sight of your specific documents.

How long will the remortgage take?

The time it takes to complete your remortgage will depend on a number of factors, including any specific conditions of your remortgage offer and how quickly your existing lender responds to any queries that we need to make. The average process takes between 3 - 5 weeks.

Outline of work

A broad outline of the work that we will undertake on your behalf is as follows:

- Take your instructions and give you initial advice

- Check the terms of your remortgage offer and advise you of any special conditions

- Ensure sufficient funds will be available to pay off your existing mortgage(s)

- Carry out any necessary searches

- Arrange for all monies needed to be received from your lender and you

- Send monies to your existing lender(s) to pay off your existing mortgage(s)

- Notify you and your lender when registration is complete and send you any balance of the remortgage.

*Our fee assumes that:

- this is a standard transaction and that no unforeseen matters arise including for example (but not limited to) a defect in title which requires remedying prior to completion of the remortgage or the preparation of additional documents ancillary to the main transaction

- the transaction is concluded in a timely manner and no unforeseen complications arise

- no indemnity policies are required. Additional legal fees and disbursements may apply if indemnity policies are required.

** This range of Land Registry fees is applicable if the transaction can be registered electronically. If not the Land Registry fee will be higher. We can advise you more precisely once you have instructed us to act for you.